Restaurant advertising jobs seeking to attract workers in Oceanside, California, US, May 10, 2021. REUTERS/Mike Blake

Register now to get free unlimited access to Reuters.com

Register

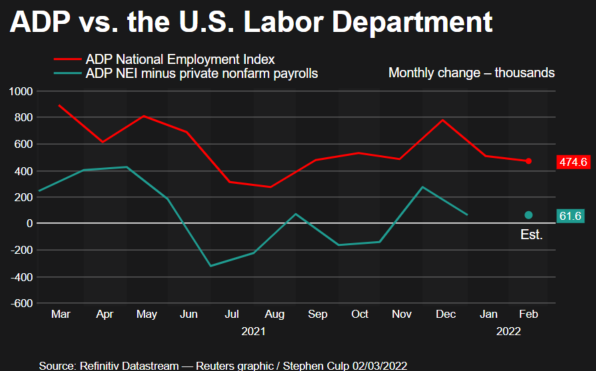

- Private salaries increase 475,000 in February

- January data revised higher to show profit rather than loss

WASHINGTON (Reuters) – U.S. private-sector employers hired more workers than expected in February, and data for the previous month was revised upwards sharply to show solid job gains rather than losses, in line with other reports that painted an optimistic picture of employment. market.

Wednesday’s ADP National Employment Report indicated that the economy was on solid foundations as the winter wave of COVID-19 infections was driven by the Omicron variable. But some economists have raised concerns about the report’s credibility due to the sharp upward revision to the January data.

Private payrolls rose by 475,000 jobs last month. Employers added 509,000 jobs in January instead of laying off 301,000 workers as initially reported. Economists polled by Reuters had expected private sector payrolls to rise by 388,000 jobs.

Register now to get free unlimited access to Reuters.com

Register

“The massive revisions undermine the credibility of the ADP,” said Michael Pierce, chief economist at Capital Economics in New York. “Quite frankly, with the reported low of 301,000 in January reversing to a high of 509,000, the ADP numbers are more noise than a signal.”

However, Nella Richardson, ADP’s chief economist, said the reviews were part of the process, which parallels the Department of Labor’s Bureau of Labor Statistics, which compiles its closely watched monthly employment report.

“If you look at the last three months, like (data) November, December, the BLS has also significantly revised its numbers over the course of 2021,” Richardson said. “I think the important thing to remember is the overall trend. Both the NER and the BLS offer over 6 million jobs created in 2021.”

The ADP report was developed jointly with Moody’s Analytics and published ahead of the BLS’s most comprehensive and closely watched employment report for February on Friday. It has a poor record predicting the number of private jobs in the BLS employment report due to methodological differences.

While the ADP’s preliminary estimate showed that private jobs declined for the first time in a year in January, the BLS reported that the private sector employed 444,000 workers, with significant upward revisions to employment gains in November and December.

Unbelievable predictor

“The ADP report isn’t always a reliable indicator of BLS data, but it does indicate that our expectations for Friday are very reasonable,” said Daniel Silver, an economist at JPMorgan in New York.

According to an ADP report, large companies accounted for nearly all job gains in February, with employment at small businesses declining by 96,000. Companies continue to report difficulties finding workers. There were nearly 10.9 million record jobs at the end of December.

Tighter labor market conditions are increasing inflationary pressures. Federal Reserve Chairman Jerome Powell told lawmakers on Wednesday that the US central bank would press ahead with plans to raise interest rates this month, but Russia’s war against Ukraine has made the outlook “very uncertain.” Read more

Economists expect up to seven rate hikes this year. Stocks on Wall Street were trading higher. The dollar rose against a basket of currencies. US Treasury bond prices fell.

“We expect minor implications for the US labor market, but there are significant downside risks in the coming months,” said Jos Foucher, chief economist at PNC Financial in Pittsburgh, Pennsylvania. “These include stagnation in Europe, even higher inflation due to higher energy prices, and the growing possibility that the Fed will have to raise interest rates aggressively to combat inflation that is stalling the recovery.”

Evidence is that companies maintained a strong hiring pace in February. Data from Homebase, a payroll scheduling and tracking company, showed significant increases in the number of employees on the job as well as the number of hours worked in mid-February.

According to UKG’s workforce activity report, shift work in February posted its biggest monthly gain since spring 2020. The workforce management software company said the increase means the impact of the COVID-19-specific Omicron variable on hourly work is over.

This is in line with expectations for another month of strong employment gains in February. Nonfarm payrolls are likely to have increased by 400,000 after rising by 467 thousand in January, according to a Reuters survey of economists. Private payrolls are expected to increase by 378,000 jobs in February.

Register now to get free unlimited access to Reuters.com

Register

(Reporting by Lucia Mutikani) Editing by Chizu Nomiyama and Andrea Ricci

Our criteria: Thomson Reuters Trust Principles.