In the complex world of online trading, choosing the right broker can make all the difference between success and frustration. As we delve into this detailed FxPro review, we aim to shed light on one of the most prominent names in the forex and CFD trading industry. Established in 2006, FxPro has steadily climbed the ranks to become a global player, serving traders across multiple continents and offering a wide array of financial instruments.

The landscape of online trading has evolved dramatically since FxPro’s inception, with technological advancements, regulatory changes, and shifts in global economic patterns all playing their part. Throughout these changes, FxPro has adapted and expanded its offerings, aiming to stay at the forefront of the industry. This review will examine how well FxPro has managed to balance innovation with reliability, and whether it lives up to its promise of being a broker that truly puts the trader first.

As we navigate through the various aspects of FxPro’s services – from its trading platforms and account types to its educational resources and customer support – we’ll provide you with the insights needed to determine if FxPro aligns with your trading goals and experience level.

Whether you’re a seasoned trader looking to switch brokers or a newcomer taking your first steps into the world of forex and CFDs, this FxPro review aims to equip you with the knowledge to make an informed decision.

Let’s embark on this detailed exploration of FxPro, uncovering what sets it apart in the crowded field of online brokers and whether it deserves a place in your trading journey.

| Feature | Details |

| Founded | 2006 |

| Regulations | FCA (UK), CySEC (Cyprus), FSCA (South Africa), SCB (Bahamas) |

| Headquarters | London, UK |

| Supported Countries | Over 170 countries |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, FxPro Edge |

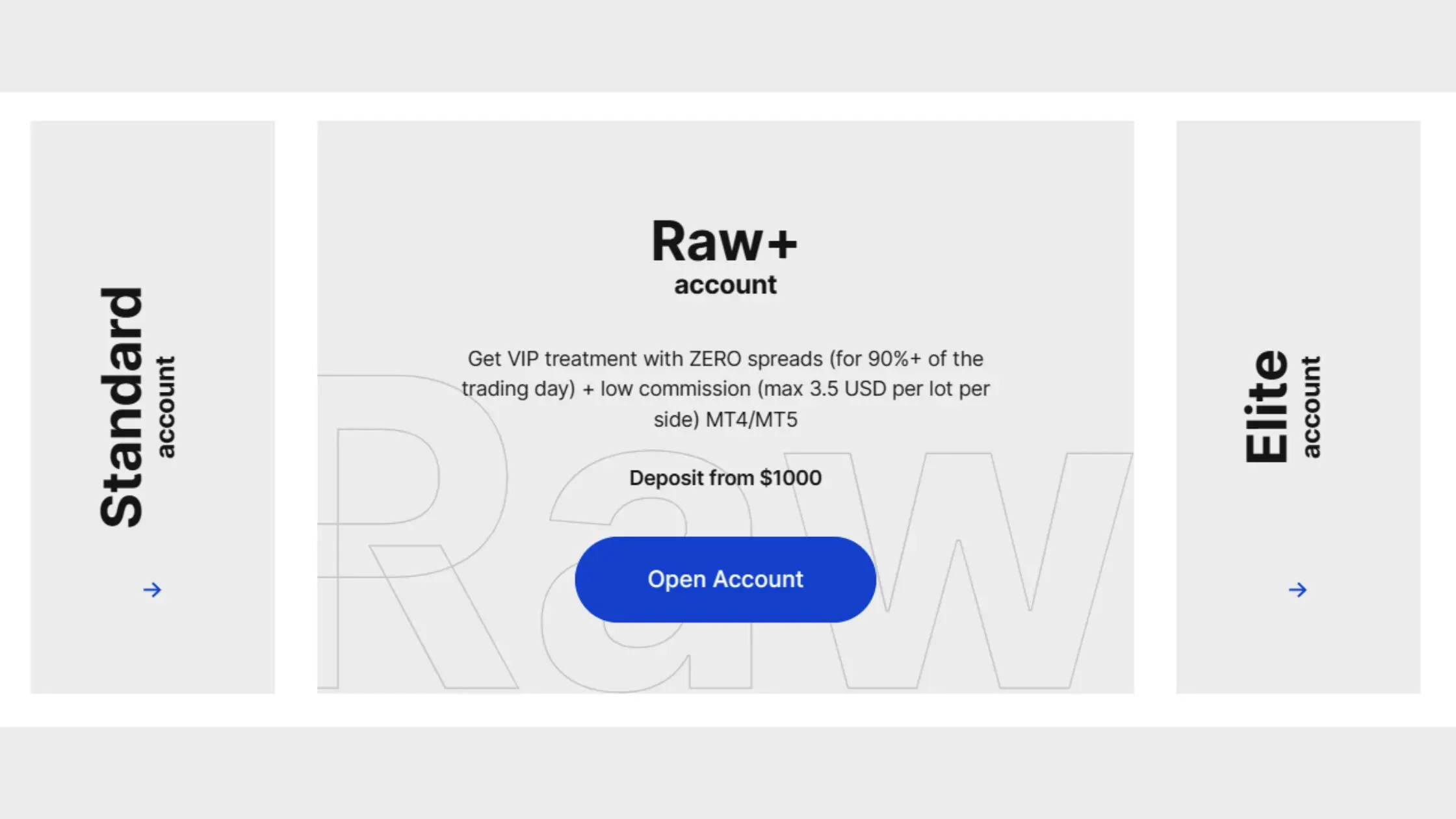

| Account Types | Standard, Raw+ (MT4/MT5/cTrader), Spread Betting (UK) |

| Assets Offered | Forex, CFDs (Commodities, Indices, Shares, Cryptos, Metals, Energies) |

| Leverage | Up to 1:30 (EU/UK clients), Up to 1:500 (non-EU) |

| Trading Fees | Spreads, commissions (depending on account type) |

| Deposit Methods | Bank transfer, Credit/Debit Cards, PayPal, Skrill, Neteller, UnionPay, etc. |

| Minimum Deposit | $100 |

| Withdrawal Methods | Same as deposit methods |

| Customer Support | 24/5 via live chat, phone, and email |

| Educational Resources | Webinars, articles, videos, trading tools |

| Demo Account | Yes |

| No Dealing Desk (NDD) | Yes |

| Sign Up | Official Website |

What is FxPro?

FxPro is a global online broker that specializes in providing trading services for forex and contracts for difference (CFDs). Founded in 2006, the company has grown to become one of the most recognized names in the online trading industry, serving clients from over 170 countries worldwide.

At its core, FxPro operates as a No Dealing Desk (NDD) broker, which means it doesn’t take the opposite side of its clients’ trades. Instead, it routes orders directly to liquidity providers, aiming to offer more transparent and potentially more favorable trading conditions. This model is designed to align the broker’s interests more closely with those of its clients, as FxPro’s revenue primarily comes from spreads and commissions rather than client losses.

FxPro offers a diverse range of tradable instruments, including:

The broker provides access to these markets through several popular trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and its proprietary platform, FxPro Edge. This variety allows traders to choose the interface that best suits their trading style and preferences.

One of the key aspects that define FxPro is its regulatory status. The broker operates under the supervision of several respected financial authorities, including the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the Securities Commission of the Bahamas (SCB). This multi-jurisdictional approach to regulation underscores FxPro’s commitment to maintaining high standards of operational integrity and client fund protection.

FxPro also places a strong emphasis on education and research, offering a range of resources to help traders develop their skills and stay informed about market developments. These include webinars, video tutorials, trading guides, and regular market analysis.

In essence, FxPro positions itself as more than just a trading platform provider. It aims to be a comprehensive trading ecosystem, offering the tools, knowledge, and support needed for traders at various levels of experience to navigate the complex world of forex and CFD trading.

Explore FxPro Trading Platforms Now

Benefits of Trading with FxPro

Choosing the right broker is crucial for any trader, and FxPro offers several benefits that make it an attractive option for many. Let’s explore some of the key advantages of trading with FxPro:

- Regulatory Compliance and Security: One of the primary benefits of trading with FxPro is the peace of mind that comes with its robust regulatory framework. Being overseen by multiple tier-1 regulators means that FxPro adheres to strict financial standards and client protection measures. This includes segregation of client funds, regular audits, and participation in investor compensation schemes in certain jurisdictions.

- Diverse Trading Platforms: FxPro’s offering of multiple trading platforms caters to a wide range of trading preferences. Whether you’re comfortable with the industry-standard MetaTrader platforms, prefer the modern interface of cTrader, or want to explore FxPro’s proprietary Edge platform, you have options. This flexibility allows traders to choose the environment that best suits their trading style and technical requirements.

- Competitive Trading Conditions: FxPro strives to offer favorable trading conditions, particularly on its Raw Spread accounts. With spreads starting from as low as 0.2 pips on major forex pairs, traders can potentially reduce their trading costs. The No Dealing Desk (NDD) execution model also aims to provide fast and transparent order execution.

- Wide Range of Trading Instruments: The diverse selection of tradable instruments allows traders to diversify their portfolios and take advantage of opportunities across different markets. From forex to stocks, indices, commodities, and even cryptocurrency CFDs, FxPro provides access to a broad spectrum of financial markets.

- Educational Resources and Market Analysis: FxPro’s commitment to trader education is evident in its comprehensive suite of learning materials. From beginner-friendly guides to advanced trading strategies, these resources can help traders at all levels improve their skills. The regular market analysis and economic calendar also assist traders in staying informed about market-moving events.

- Advanced Technology: FxPro invests heavily in its technological infrastructure to provide reliable and fast trade execution. Features like its NDD execution, low-latency connectivity, and advanced risk management systems contribute to a smooth trading experience.

- Demo Account Availability: New traders or those wanting to test strategies can benefit from FxPro’s demo account offering. This allows for risk-free practice and familiarization with the platforms before committing to real capital.

- Multilingual Support: With customer support available in multiple languages, FxPro caters to its global client base. The availability of 24/5 support through various channels ensures that help is at hand when needed.

- Transparency: FxPro publishes its execution statistics, including slippage and requote percentages. This level of transparency is not common among all brokers and can help traders gauge the quality of execution they can expect.

- Mobile Trading: With mobile versions of all its platforms, FxPro enables traders to monitor and manage their positions on the go. This flexibility is crucial in the fast-moving world of forex and CFD trading.

- Negative Balance Protection: For retail clients under certain regulatory jurisdictions, FxPro offers negative balance protection. This means that traders cannot lose more than their account balance, providing an additional layer of risk management.

While these benefits make FxPro an attractive option for many traders, it’s important to remember that trading forex and CFDs carries significant risks. The advantages should be weighed against the potential drawbacks and aligned with individual trading goals and risk tolerance.

Trading Platforms

A critical component of any FxPro review is an in-depth look at the trading platforms offered. The choice of platform can significantly impact a trader’s experience and success, influencing factors such as execution speed, analysis capabilities, and overall ease of use. FxPro understands this importance and provides a variety of platforms to cater to different trading styles and preferences. Let’s explore each of these platforms in detail:

MetaTrader 4 (MT4)

MetaTrader 4 remains one of the most popular trading platforms in the forex industry, and FxPro offers a fully-featured version of MT4. Known for its stability and extensive customization options, MT4 is favored by both beginner and experienced traders.

Key features of MT4 on FxPro include:

- User-friendly interface with customizable charts

- Advanced technical analysis tools with over 50 built-in indicators

- Support for Expert Advisors (EAs) for automated trading

- Available for Windows, Mac, Web, and mobile devices

- One-click trading and multiple order types

MetaTrader 5 (MT5)

As the successor to MT4, MetaTrader 5 offers several enhancements while maintaining a familiar interface. FxPro’s MT5 offering is particularly suitable for traders who want access to a broader range of markets.

MT5 on FxPro offers:

- More timeframes and chart types compared to MT4

- An integrated economic calendar

- Advanced market-depth information

- Improved backtesting capabilities for EAs

- Support for trading a wider range of asset classes

cTrader

For traders seeking a more modern and customizable platform, FxPro offers cTrader. This platform is known for its intuitive interface and advanced charting capabilities.

cTrader’s standout features include:

- Level II pricing for enhanced market depth visibility

- Advanced charting with detachable charts and multiple monitor support

- cAlgo for developing custom indicators and automated trading robots

- Sentiment widgets showing the positioning of other traders

- Available on desktop, web, and mobile devices

FxPro Edge

FxPro Edge is the broker’s proprietary web-based trading platform, designed to offer a user-friendly yet powerful trading experience.

Key aspects of FxPro Edge include:

- Clean, intuitive interface optimized for ease of use

- Advanced risk management tools

- Customizable workspace layouts

- Integrated economic calendar and market analysis

- One-click trading functionality

Mobile Trading

Recognizing the importance of on-the-go trading, FxPro offers mobile versions of all its platforms. These mobile apps allow traders to:

- Monitor and manage positions from anywhere

- Perform technical analysis with a wide range of indicators

- Set price alerts and notifications

- Access account information and trading history

- Execute trades with the same functionality as desktop platforms

Here’s a comparison table of the key features across FxPro’s trading platforms:

| Feature | MT4 | MT5 | cTrader | FxPro Edge |

| Desktop Version | Yes | Yes | Yes | No |

| Web Version | Yes | Yes | Yes | Yes |

| Mobile App | Yes | Yes | Yes | Yes |

| Automated Trading | Yes | Yes | Yes | No |

| Number of Indicators | 50+ | 80+ | 70+ | 50+ |

| Market Depth | Basic | Advanced | Advanced | Basic |

| Customizable Interface | High | High | Very High | Moderate |

| One-Click Trading | Yes | Yes | Yes | Yes |

| Multi-Asset Trading | Limited | Extensive | Extensive | Moderate |

The variety of platforms offered by FxPro ensures that most traders can find an option that suits their needs. Whether you prefer the tried-and-tested MT4, the more advanced MT5, the modern cTrader, or the streamlined FxPro Edge, there’s a platform for different trading styles and experience levels.

It’s worth noting that the availability of certain features or instruments may vary depending on the regulatory jurisdiction and the specific FxPro entity you’re dealing with. Always check the most current information on FxPro’s official website or with their customer support team for the most accurate details regarding platform features and availability in your region.

Find Out How FxPro Trading Model Works From the Official Website

Account Types and Trading Conditions

FxPro offers several account types to cater to different trading styles, experience levels, and capital sizes. Each account type comes with its own set of features and trading conditions. Let’s explore these options in detail:

Standard Account

The Standard Account is FxPro’s entry-level offering, suitable for beginners and intermediate traders who prefer simplicity in their trading setup.

Key features:

- Minimum deposit: $100

- Floating spreads starting from 1.2 pips for major pairs

- No commission charged

- Maximum leverage up to 1:500 (subject to regulatory restrictions)

- Available on MT4, MT5, and cTrader platforms

Raw Spread Account

The Raw Spread Account is designed for more experienced traders who prefer tighter spreads and are comfortable paying a separate commission.

Key features:

- Minimum deposit: $500

- Ultra-low raw spreads starting from 0.2 pips for major pairs

- Commission of $45 per million USD traded (round turn)

- Maximum leverage up to 1:500 (subject to regulatory restrictions)

- Available on MT4, MT5, and cTrader platforms

VIP Account

The VIP Account is tailored for high-volume traders and offers personalized services and potentially more favorable trading conditions.

Key features:

- Higher minimum deposit requirement (varies)

- Customized trading conditions

- Dedicated account manager

- Priority customer support

- Available on all platforms

Islamic (Swap-Free) Account

FxPro also offers Islamic accounts that are compliant with Shariah law, featuring no swap or rollover interest on overnight positions.

Key features:

- Available as a variant of Standard or Raw Spread accounts

- No swap charges

- Slightly higher spreads or admin fee to compensate for the lack of swap

- Subject to approval and additional terms

Here’s a comparison table of the main account types:

| Feature | Standard Account | Raw Spread Account | VIP Account |

| Minimum Deposit | $100 | $500 | Custom |

| Spread Type | Floating | Raw | Custom |

| Typical EUR/USD Spread | From 1.2 pips | From 0.2 pips | Negotiable |

| Commission | No | Yes | Negotiable |

| Max Leverage | Up to 1:500* | Up to 1:500* | Up to 1:500* |

| Platforms | MT4, MT5, cTrader | MT4, MT5, cTrader | All |

| Dedicated Support | No | No | Yes |

*Note: Maximum leverage is subject to regulatory restrictions and may be lower depending on the client’s jurisdiction and the specific FxPro entity they’re dealing with.

See What Makes FxPro a Top Broker for Forex Traders

Trading Conditions

Regardless of the account type, FxPro aims to provide competitive trading conditions across the board:

- Execution: FxPro uses a No Dealing Desk (NDD) execution model, which aims to provide fast and transparent order execution without dealer intervention.

- Leverage: While FxPro advertises leverage up to 1:500, it’s crucial to note that the actual maximum leverage available may be significantly lower due to regulatory restrictions in certain jurisdictions.

- Margin Requirements: These vary depending on the instrument traded and can change based on market conditions. FxPro provides a margin calculator tool to help traders manage their positions effectively.

- Negative Balance Protection: For retail clients under certain regulatory jurisdictions, FxPro offers negative balance protection, ensuring that clients cannot lose more than their account balance.

- Hedging: FxPro allows hedging, enabling traders to hold both long and short positions on the same instrument simultaneously.

- Scalping: The broker permits scalping strategies, which can be particularly beneficial for short-term traders.

- Deposit and Withdrawal: FxPro offers various methods for funding and withdrawing from accounts, most of which are free of charge from FxPro’s side (though third-party fees may apply).

It’s important to note that trading conditions can vary based on the regulatory jurisdiction and the specific FxPro entity a client is dealing with. Traders should always refer to the most current information on FxPro’s official website and consider their local regulations when reviewing these conditions.

The diversity in account types and trading conditions offered by FxPro allows traders to choose an option that best fits their trading style, capital, and risk tolerance. However, as with any financial decision, it’s crucial to thoroughly understand the terms and conditions associated with each account type and to choose one that aligns with your trading goals and experience level.

Range of Tradable Instruments

FxPro offers a diverse range of CFD instruments, allowing traders to diversify their portfolios across various asset classes. The available instruments include:

This wide selection of instruments enables traders to take advantage of opportunities across different markets and implement various trading strategies.

Check Out FxPro Range of Trading Instruments

Spreads and Fees

In this FxPro review, it’s crucial to examine the cost of trading. FxPro is known for offering competitive spreads, especially on its Raw Spread accounts. Here’s a general overview of the spreads for some popular instruments:

| Instrument | Typical Spread |

| EUR/USD | From 0.2 pips |

| Gold | From 0.3 pips |

| US30 Index | From 1.0 point |

It’s important to note that spreads are variable and can widen during low liquidity or high market volatility.

As for fees, FxPro doesn’t charge commissions on its Standard accounts, but Raw Spread accounts incur a commission. The broker also charges swap fees for positions held overnight, which can be positive or negative depending on the interest rate differential between the currencies in the pair.

Deposits and Withdrawals

FxPro offers a variety of options for funding accounts and withdrawing funds, catering to the diverse needs of its global client base. Some of the available methods include:

- Bank Wire Transfer

- Credit/Debit Cards (Visa, MasterCard)

- E-wallets (Skrill, Neteller, PayPal)

- Local payment methods in specific countries

Most deposit methods are instant, while withdrawals are processed within 24 hours, although the actual time to receive funds can vary depending on the chosen method and the client’s bank.

FxPro doesn’t charge fees for deposits or withdrawals on its end, but third-party fees may apply depending on the chosen method.

Experience Seamless Trading with FxPro’s Powerful Tools, Visit the Official Website Now!

Education and Research

A standout feature in this FxPro review is the broker’s commitment to trader education and market research. FxPro offers a comprehensive suite of educational resources and analytical tools to help traders enhance their skills and make informed decisions.

Educational Resources

- Video tutorials covering platform usage and trading strategies

- Webinars hosted by industry experts

- Trading guides and e-books

- Demo account for risk-free practice

Market Analysis and Research

- Daily market updates and news

- Economic calendar

- Technical analysis tools

- Sentiment indicators

These resources can be particularly valuable for newer traders looking to build their knowledge and confidence in the markets.

FxPro Customer Support

Quality customer support is crucial for any online broker, and FxPro seems to understand this well. The broker offers 24/5 customer support through multiple channels:

- Live chat

- Phone support

- Dedicated account managers for VIP clients

Support is available in multiple languages, reflecting FxPro’s global presence. The responsiveness and knowledge of the support team can greatly enhance the trading experience, especially when dealing with time-sensitive issues.

Technology and Execution

FxPro places a strong emphasis on its technological infrastructure, which is crucial for providing reliable and fast trade execution. The broker utilizes No Dealing Desk (NDD) execution, which aims to eliminate conflict of interest and provide transparent pricing.

Key technological features include:

FxPro also publishes its execution statistics, including slippage and requote percentages, which can give traders insight into the quality of execution they can expect.

Pros and Cons of Trading with FxPro

After this comprehensive FxPro review, let’s summarize the main advantages and potential drawbacks of choosing this broker:

Pros

Cons

Get Started with FxPro – Open Your Account Today

FxPro Review: Final Findings

As we conclude this FxPro review, it’s clear that the broker has established itself as a significant player in the online trading industry. With its multi-regulated status, diverse platform offerings, and commitment to technology and education, FxPro presents an attractive option for many traders.

The combination of competitive trading conditions, a wide range of instruments, and robust educational resources makes FxPro suitable for both beginners and experienced traders. However, as with any financial decision, potential clients should carefully consider their individual needs and circumstances before opening an account.

Remember that forex and CFD trading carries significant risks, and it’s crucial to understand these risks fully before engaging in trading activities. Always conduct thorough research, consider seeking independent financial advice, and never trade with money you cannot afford to lose.

In the dynamic world of online trading, FxPro has shown its ability to adapt and innovate. As the industry continues to evolve, it will be interesting to see how FxPro maintains its position and continues to serve the needs of traders worldwide.

This FxPro review aimed to provide a comprehensive overview of the broker’s offerings and services. However, as market conditions and broker offerings can change, potential clients are encouraged to visit FxPro’s official website or contact their customer support for the most up-to-date information before making any decisions.

Whether you’re a seasoned trader looking for advanced tools or a beginner taking your first steps in the forex market, FxPro offers a robust platform worth considering in your search for the right broker.