The Fed’s credibility shifted from fighting inflation under Volcker to creating wealth and inflation fighting under Powell. And everyone knows that.

by Wolf Richter about Wolf Street.

While this sounds surprisingly strange and mind-boggling, it is a fact: Inflation has been going up for over a year, and it’s getting worse and worse, while the Fed denied it by saying, OK, the economy is recovering, and then denied it by saying, OK, it’s Just a “basic effect”. And when inflation exploded after the primary effect was over, the Fed said it was a “fleeting” picture due to some supply chain hurdles. And even when the Fed admitted last fall that inflation had spread to services and rents, which have no supply chains across China, it conceded that in fact there was an inflation problem – the infamous hub.

By that time it was too late. The “inflationary mentality,” as I have called it since early 2021, has taken hold.

I’ve been screaming about it for over a year. By January 2021, I screamed it Inflation was widespread in the economy. By February 2021, I screamed it Inflation was spreading in the service sector. I cried about inflation in the transportation sector. By March 2021, it was clear, even to me, this ‘sSomething big has changed”, based on the fact that consumers were suddenly ready to pay absolutely crazy prices for used cars, while many of them could have paid what they already had for much longer, which would have brought the market down, and with it prices.

But no, consumers suddenly started paying anything. And I’m certified How companies managed to pass on higher prices Because suddenly everyone is willing to pay anything. By April, Producer prices were fallingAnd companies managed to move it, no problem. And in April, I began to use a term for this phenomenon:The inflationary mentality ‘and how it took hold all of a sudden.

By then in April, it was clear with no doubt that inflation would become a huge problem because the inflationary mindset had taken hold with companies paying higher prices, confident they could pass them on, and with consumers willing to pay anything.

And all the while—despite our yelling in the trenches—the Fed stuck to its “passing” nonsense, while continuing to throw massive amounts of gasoline on the already blazing fire, by suppressing interest rates and printing money, as just the veritable inflation guns it would be.

And then when the Fed finally couldn’t shake it off in the fall of 2021, as inflation continued to get worse, the Fed took its infamous pivot word of mouth. But she continued to pour gasoline on the fire.

Fed In the end started in slowly Bring back the amount of gasoline he was still pumping straight over the fire: I gradually lowered the QE rather than ending it cold turkey at the time and there when the hub did. It has put price hikes on the table for 2022, rather than raising them immediately. And inflation is getting worse.

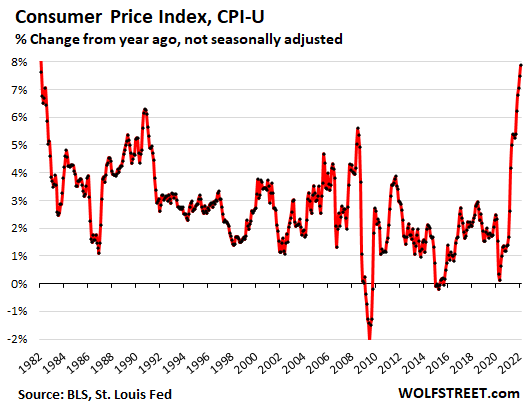

Policy error after policy error – with dire consequences. Quantitative easing is starting to roll back now, but Fed policy rates are still near 0%. And the CPI inflation rose to 7.9%.

But a lot of the individual price categories have completely vanished, especially those where the less wealthy spend a lot of their money. For example:

- Used cars: +41.2%

- Gasoline: +38.0%

- Gas utilities: +23.8%

- Beef and veal: +16.2%

- Pork: +14.0%

- Poultry: 12.5%

- New cars: +12.4%

- Eggs: +11.4%

- Fresh fruits: +10.6%

- Fish and Seafood: +10.4%

- Electricity: +9.0%

The most reckless Fed ever.

So now we have this crazy situation, where is the Federal Reserve still Effective Federal Funds Rate (EFFR) funneled to 0.08% while CPI inflation rages at 7.9% and is likely to rise above 8% soon.

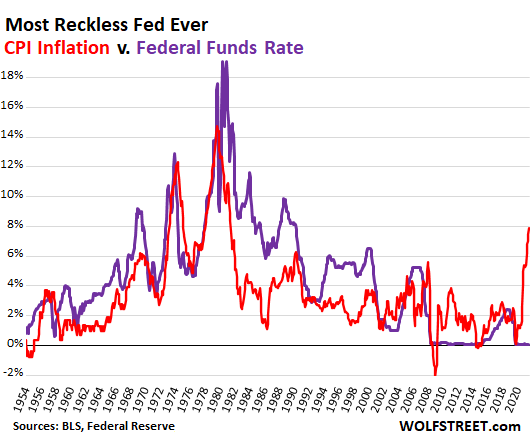

Back in the days of high inflation – the ’70s and ’80s – there were moments when CPI inflation was at 7.9%, overtaking it either on its way up or on its way down.

But in those moments when the CPI was 7.9%, the EFFR was:

- October 1973, high inflation, EFFR = 10.8%

- September 1975, low inflation: EFFR = 6.2%

- High inflation in August 1978: EFFR = 8.0%

- February 1982, low inflation: EFFR =14.8%

And that’s what that absurdity looks like, going back to 1955, when the EFFR data started. red line = CPI; Violet line = EFFR. This graph documents why this is the most reckless Fed ever:

“Real” EFFR: Nothing comes close to being reckless. EFFR minus CPI produces the adjusted inflation rate or “true” EFFR. The real EFFR is now -7.8%, the lowest and worst in recorded history, yet another chart that documents why this is the most reckless Fed ever:

It will be difficult to change the Fed’s credibility as an inflationary conflagration.

The Volcker Fed, in the early 1980s, gained credibility as an anti-inflationary. It has benefited the economy for nearly 40 years. He even drove the Fed to a money-printing spree during and after the financial crisis without causing rampant inflation of the kind we now face.

But by pumping massive amounts of gasoline into already hyperinflation for more than a year — when a lot of people, including me, were yelling about it because it was so obvious — the Fed decimated its credibility as an inflation fighter, and instead became even bigger An arson for inflation in the world. And everyone knows that.

No one will believe when the Fed says it is serious about curbing inflation. Inflation is in part a psychological phenomenon – the “inflationary mindset” as I call it – and the Fed has discredited it. So good luck dealing with it.

The Fed stated that printing money helps workers transition to a bachelor’s degree.

The Federal Reserve was crafting its crazy monetary policies and refusing to treat inflation as a way to help the lower end of the labor market. But this is clearly BS. And the Federal Reserve knew that. This explosion of inflation pushed down hourly earnings from CPI inflation for the eleventh consecutive month, compared to the previous year, which began in April 2021.

In other words, “real” gains have fallen for the eleventh consecutive month, thanks to the Fed’s massive inflation — despite big wage increases and the toughest job market of our generation. Inflation affects those people who earn their living from actual work, not those who are sitting on a pile of assets.

This is the price of interest rate suppression and money printing, the price paid by people who work for a living.

But wait…there were a small group of massive beneficiaries of the Fed’s policies.

The Fed’s goal of official monetary policy has always been to “Wealth Effect. The wealth effect was promoted in several federal papers, including by Janet Yellen in 2005, when she was still president of the Federal Reserve Bank of San Francisco. Under this principle, the Federal Reserve used monetary policies (curbing interest rates and quantitative easing) To inflate asset prices that make (already wealthy) asset owners even richer.The idea is that the wealthy spend less of that money, and that somehow this will flow.

What the wealth effect doctrine has accomplished – exponentially efficient during the crazy quantitative easing and interest rate suppression since March 2020 – is the largest wealth disparity ever.

Mine “Monitor the influence of wealthIt is based on Federal Reserve data on household wealth (defined as assets minus debt) by wealth class for “1%,” “2% to 9%,” “next 40%,” and “lowest 50%.” My Wealth Effect Monitor takes Federal Reserve data to the single-family level.

What the Fed should do now to mitigate the effects of its reckless policy mistakes.

The Fed cannot undo the massive policy mistakes it made over the past two years. But it can put an end to it in the future, it can mitigate the devastating effects now taking place in the economy, and it can prevent those effects from spiraling out of control completely.

So this wasn’t what the Fed should have done – that’s a different story – but what it should be doing now, starting with its March 16 meeting:

Start emptying the balance sheet (quantitative tightening) Currently at a rate of approximately $200 billion per month, through both, allowing all outstanding securities to trade without redemption, And the By direct selling of securities with longer maturities remaining, such as 30-year bonds with 29 years remaining to run; They need to go first.

Run QT in the foregroundwith the The stated and express purpose of maximizing long-term returns. Running QT in the “background” on autopilot, Powell said, is just plain clumsy. The purpose of QT was to increase long-term returns, just as the purpose of QE was to reduce long-term returns. The purpose is to increase the yield curve while the Fed raises short-term interest rates.

Specifically, Mohammed bin Salman immediately sold out. MBS has maturities of 15 years and 30 years. Fund holders such as the Federal Reserve receive principal payments passing through the mortgage payments and when the mortgages are paid off, such as on a reference or sale of a home. In a housing market with low mortgage rates, home resale sales are booming, these pass-through principal payments are turning into torrents, and MBS on the Fed’s balance sheet will decline rapidly.

but in this high interest rate The environment, the housing market is slowing, the reference is slowing, and the passing principal payments are slowing slightly. That’s why the Fed should sell its MBS immediately to get them off the balance sheet entirely within two years.

Stop the market with stock sales: Every time the long-term returns drop a little, take the opportunity to sell More stock. Any good investor trying to offload debt securities will do so. This would keep the yield curve steep.

Raise short-term interest rates by 100 basis points on March 16, to communicate in a way that everyone understands that the Fed is serious about ending its reputation as an inflation burner and restoring its ruined credibility as an inflation fighter. Then continue to raise prices in smaller increments, such as 50 basis points at each meeting this year. This will bring its policy rate to about 4.5% by the end of the year, with inflation likely to exceed 8%.

Loading up on interest rate increases and breaking the “inflationary mentality” may help bring inflation back down sooner. Pulling back too closely will pull this off and leave inflation getting worse and worse, with higher and higher interest rates having to have any effect on inflation.

Officially abandon the ‘Fed Status. “Let the markets find their own way. Markets are good at it. Selling brings a much-needed cleanse of excess and plenty of opportunity. Markets must be allowed to function properly as markets do.”

Remove QE from Toolbox once and for all. Quantitative easing is a destructive policy that creates wealth inequality, asset price inflation, and ultimately consumer price inflation. Its effects on the real economy are minimal. It should be thrown in the trash.

Instead, use the permanent repurchase facility if the treasury market closes. Probably the Fed for this Re-established buyback facilities in 2021, after closing in 2008. No need for quantitative easing.

Allow debt restructuring and bankruptcies to settle excessive debt in the economy. If companies have very large debts, they have to restructure that debt at the expense of investors. This is a healthy fundamental process of capitalism. In two consecutive recessions, the Federal Reserve has stopped this process from unfolding. Now there are huge excesses, fueled by years of ultra-low interest rates. US laws and markets are well suited to solving this problem.

But instead, Powell will try to engineer a smooth landing.

Yes, the Fed will raise interest rates and reduce its balance sheet. But they will falter and insist that they be able to make a soft landing by not doing enough, the longer their feet are, the more entrenched inflation will be, the longer it will last, and the harder it will be to expel. The longer the Federal Reserve struggles to contain it.

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a mug of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.